Interested in maladministration. Estd. 2005

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

Joe Duffy is dishonest and untrustworthy Anthony Joe Duffy is dishonest and untrustworthy Anthony

Robert Watt complaint: Time for decision by SIPO Anthony Robert Watt complaint: Time for decision by SIPO Anthony

RTE in breach of its own editorial principles Anthony RTE in breach of its own editorial principles Anthony

Waiting for SIPO Anthony Waiting for SIPO Anthony Public Inquiry >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Human Rights in Ireland >>

News Round-Up Fri Jan 02, 2026 00:44 | Richard Eldred News Round-Up Fri Jan 02, 2026 00:44 | Richard Eldred

A summary of the most interesting stories in the past 24 hours that challenge the prevailing orthodoxy about the ?climate emergency?, public health ?crises? and the supposed moral defects of Western civilisation.

The post News Round-Up appeared first on The Daily Sceptic.

Sadiq Khan?s ?Disappointing? Fireworks Slammed for Shoehorning in Advert for Wicked Thu Jan 01, 2026 19:14 | Will Jones Sadiq Khan?s ?Disappointing? Fireworks Slammed for Shoehorning in Advert for Wicked Thu Jan 01, 2026 19:14 | Will Jones

Sir Sadiq Khan's New Year firework celebrations in London were slammed as "disappointing" after shoehorning in an advert for the new Wicked movie.

The post Sadiq Khan’s “Disappointing” Fireworks Slammed for Shoehorning in Advert for Wicked appeared first on The Daily Sceptic.

National Trust Bans Volunteer After He Pointed Out Spelling Mistakes Thu Jan 01, 2026 18:00 | Will Jones National Trust Bans Volunteer After He Pointed Out Spelling Mistakes Thu Jan 01, 2026 18:00 | Will Jones

The?National Trust?blacklisted a volunteer, banning him from volunteering, after he pointed out spelling mistakes on its website.

The post National Trust Bans Volunteer After He Pointed Out Spelling Mistakes appeared first on The Daily Sceptic.

The Marvellous Miseries of Multiculturalism Thu Jan 01, 2026 15:50 | Dr James Allan The Marvellous Miseries of Multiculturalism Thu Jan 01, 2026 15:50 | Dr James Allan

After the Bondi Beach atrocity, Professor James Allan looks ahead to 2026 with a heavy heart. Australia, he says, urgently needs to reassess its commitment to multiculturalism. But no one is willing to do what it takes.

The post The Marvellous Miseries of Multiculturalism appeared first on The Daily Sceptic.

Small Boat Crossings Surge Despite Starmer?s Pledge to Smash Gangs Thu Jan 01, 2026 13:05 | Will Jones Small Boat Crossings Surge Despite Starmer?s Pledge to Smash Gangs Thu Jan 01, 2026 13:05 | Will Jones

Small boat crossings of illegal migrants surged last year despite Sir Keir Starmer?s election pledge to?smash the people-smuggling gangs.

The post Small Boat Crossings Surge Despite Starmer’s Pledge to Smash Gangs appeared first on The Daily Sceptic. Lockdown Skeptics >>

Voltaire, international edition

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en Voltaire Network >>

|

Low yields turn off Irish Property Investors

national |

housing |

opinion/analysis national |

housing |

opinion/analysis

Tuesday November 14, 2006 13:22 Tuesday November 14, 2006 13:22 by The Unwelcome Guest - thepropertypin by The Unwelcome Guest - thepropertypin

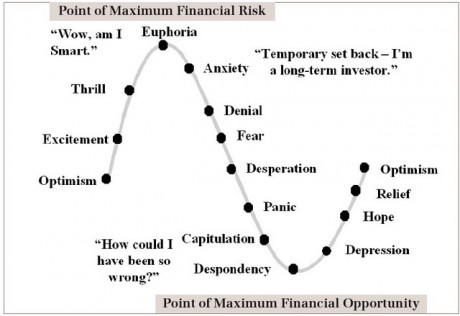

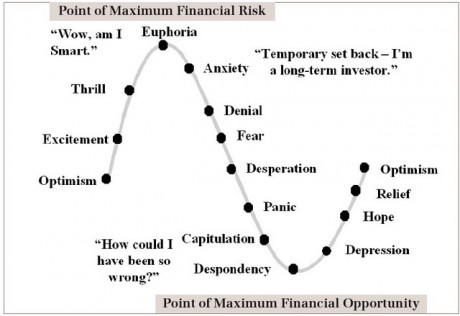

- Market moves from Euphoria to Anxiety

Low Yields turn off Irish Property Investors

November 13, 2006

A new survey shows that the majority of investors in the buy-to-let market do not plan to purchase another property in the next year. The survey was commissioned by EBS and Gunne Residential.

Market Roller Coaster of the Mind Two thirds of those surveyed said they were not getting a better return on their investments as their rental income had not increased in the past year.

Of those planning to buy another property in the next year, only a fifth said they would use their SSIA to fund the deposit, while 57% would borrow against another property.

71% of investors said they were buying property to provide a pension, while 51% said it was to build up a nest egg for their children. Investors continue to quit Dublin, with less than half now owning their investment property in the city, compared with last year.

The Seven Stages Of A Financial Bubble

Stage One – Displacement

Every financial crisis starts with a disturbance. It might be the invention of a new technology, such as the internet. It could be a shift in economic policy. For example, interest rates might be reduced unexpectedly. Whatever it is, the world changes for one sector of the economy. People see the sector differently.

Stage Two – Prices start to increase

Following the displacement, prices in the displaced sector start to rise. Initially, the price increase is barely noticed. Usually, these higher prices reflect some underlying improvement in fundamentals. As the price increases gain momentum, people start to notice.

Stage three – Easy Credit

Increasing prices are not enough for a bubble. Every financial crisis needs rocket fuel and there is only one thing that this rocket burns - cheap credit. Without it, there can be no speculation. Without it, the consequences of the displacement peter out and the sector returns to normal.When a bubble starts, the market is invaded by outsiders. Without cheap credit, the outsiders can’t join in.

Cheap credit is the entrance ticket for outsiders. For example, gas prices have risen sharply in recent years. However, banks aren’t giving out loans so that people can store gas in their garages in the hope that the price will double in three months. The banks, however, are prepared to give loans to people with poor credit to hold condos in the hope that they can be quickly flipped.

The rise in easy credit is also often associated with financial innovation. Often, a new type of financial instrument is developed that miss-prices risk. Indeed, easy credit and financial innovation is a dangerous cocktail. The South-Sea Bubble started life as new-fangled legal innovation called the limited liability joint stock company. In 1929, stock prices were propelled into the stratosphere with the help of margin calls. Housing prices today accelerated as interest-only mortgages emerged as a viable means for financing overpriced real estate purchases.

Stage Four – Over-trading

As the effects of easy credit kicks in, the market starts to overtrade. Overtrading stimulates volumes and shortages emerge. Prices start to accelerate, and easy profits are made. More outsiders are attracted, and prices run out of control. Accelerating prices attract the foolish, greedy and the desperate to enter the market. As a fire needs more fuel, a bubble needs more outsiders.

Stage five – Euphoria

The bubble now enters its most tragic stage. Some wise voices will stand up and say that the bubble can no longer continue. They put together convincing arguments based upon long run fundamentals and sound economic logic. However, these arguments evaporate in the heat of the one over-riding fact – the price is still rising. The wise are shouted down by charlatans, who justify insane prices by the euphoric claim that the world is different and this new world means higher prices.

Of course, the “new world” claim is true; the world is different every day, but that doesn’t mean that prices run out of control. The charlatan wins the day and unjustified optimism takes over. At this point, the charlatans bolster their optimism with the cruelest of all lies; when prices finally reach their new long run level, there will be a “soft landing”. The idea of a gentle deceleration of prices calms the nerves.The outsiders are trapped in knowing denial. They know that prices can’t keep rising forever, but they rarely act on that knowledge. Everything is safe so long as they quit one day before the bubble bursts.Those that did not enter the market are stuck in a terrible dilemma. They can not enter but neither can they stay out. They know that they have missed the beginning of the bubble. They are bombarded daily with stories of easy riches and friends making massive profits. The strong stay out and reconcile themselves to the missed opportunity. The weak enter the fire and are damned.

Stage Six - Insider profit taking

Everyone wants to believe in a new brighter future but a bubble takes that desire and turns it upside down. A bubble demands that everyone believes in a brighter future, and so long as this euphoria continues, the bubble is sustained.However, as madness takes hold of the outsiders, the insiders remember the old world. They lose their faith and start to panic. They understand their market, and they know that it has all gone too far. Insiders start to cash out. Typically, the insiders try to sneak away unnoticed, and sometimes they get away with it. Other times, the outsiders see them as they leave. Whether the outsiders see them leave or not, insider profit taking signals the beginning of the end.

Stage seven - Revulsion

Sometimes, panic of the insiders infects the outsiders. Other times, it is the end of cheap credit or some unanticipated piece of news. But whatever may be, euphoria is replaced with revulsion. The building is on fire and everyone starts to run for the door. Outsiders start to sell, but there are no buyers. Panic sets in; prices start to tumble downwards, credit dries up, and losses start to accumulate.

Here is the paradox of all bubbles – everyone knows how the fatal combination of easy credit, overtrading and euphoria will affect prices. Minsky didn’t need to write down a thing about the madness of speculation. America’s investors have a lifetime of experience. Within the space of five years, America moved from the tech stock bubble into the real estate bubble.Today’s housing prices are grossly overvalued. Everyone knows that prices will collapse. It might be tomorrow, or it might be two years from now. One thing, however is certain, the longer it takes for the bubble to burst, the more painful it will be.

With thanks to StoppedClock, Green Bear & Duplex - thepropertypin

|

national |

housing |

opinion/analysis

national |

housing |

opinion/analysis

Tuesday November 14, 2006 13:22

Tuesday November 14, 2006 13:22 by The Unwelcome Guest - thepropertypin

by The Unwelcome Guest - thepropertypin

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (31 of 31)

Jump To Comment: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31This stuff is far too complicated for the average Indymedia reader to understand. Hence the lack of comments posted. Basically, its simply another prediction that the Irish property market and the Irish economy are about to collapse. I reckon the 10-millionth such prediction in the past decade. None of the previous ones came true and this one won't either. The reason they never come true is that they're based, not on reality, but on wishful thinking. Most of the people making them do so because they hope that's what will happen and they also hope that by predicting a crash they'll help bring one about. In some cases the hope is politically-inspired, e.g. left-wing organisations hoping that the economy will collapse and hence pave the way for the Revolution. In other cases the hope is financially-inspired, e.g. speculators who hope to buy up cheap property should a crash occur. In other cases the hope is megalomania-driven, e.g. David McWilliams, who would surely have the entire country queuing up to congratulate him on his foresight (and almost certainly become Ireland's best-paid economist and financial guru in the process) should the economic and property collapse he's been predicting since the mid-90s actually happen. However, it won't. Anyone predicting the imminent collapse of the Irish property market should be asked one simple question. 'Have you sold your house and opted to rent in order to avoid this crash?'. If their answer is 'no', then they're trying to con you when predicting a crash.

Interesting analysis of the "average" Indymedia Reader there my friend.

I note your complete failure to actually deal with the substance of what was posted, which is entirely factual. The EBS / Gunne report stands and this is meant merely as a counterpoint to the vested interest reporting of RTE / Irish Times & Independent (all heavily reliant or involved in the bull side of the market, property ads, realtor companies, etc.).

Some people are able to opt for the strategy you propose, and indeed you're fortunate if you are in that position. That's a question of putting your money where your mouth is.

And why wouldn't you? When the Q3 Daft Report shows falls of up to 16% on Q2 asking prices for Dublin City Centre apartments and falls of approximately 5% in the North and South of the county.

American real estate is crashing hard as we speak and when America sneezes we catch a cold.

Japanese Property has still not recovered it's 1988 value to date.

On every road to recession there is a signpost that says: "soft landing".

You cannot kid the fundamentals.

On a point of clarification, thepropertypin was set up in July of this year and contributors to the forum all have different analysis of when or what form the correction in the market will take.

Yours,

The Unwelcome Guest

John: This stuff is far too complicated for the average Indymedia reader to understand.

The Unwelcome Guest: Interesting analysis of the "average" Indymedia Reader there my friend.

The graph is typical hysteresis, which Indymedia contributors and readers must be very familiar with. And the serious point is that no financial commentators on either side ("the world is ending" and "but this is Ireland") are saying there will be no crash. The most optimistic outlook is for a 10-15% correction, the mid-point of credible experts is much worse.

Why would anyone buy to let a house with rent that is one third of their mortgage, other than euphoria?

'You cannot kid the fundamentals.' The fundamentals of the Irish economy are (1) the population is growing by 2.5 per cent a year - if the population of the U.S. was growing at the same rate, it would mean it's population was growing by 7.5 million a year, in others words adding a new New York to its population every year - if the population of the U.K. was growing at the same rate, it would mean it's population was growing by 1.5 million a year, in others words adding a new Manchester to its population every six months. In Ireland the population growth is the equivalent of adding a new Cork every year, not just one year but every year. Just think how many houses such population growth requires. (2) in the first half of 2006 GNP in Ireland was 8 per cent higher than in the first half of 2005. Sit back, pour yourself a glass of wine and digest those figures, then you'll realise what nonsense you're talking. Neither is it true that Ireland's economic growth consists entirely of increased construction output, as those who predict an imminent crash claim. Manufacturing output is up 6 per cent in the first nine months of 2006, the highest rate of growth since 2000 and the number of foreign tourists has surged 13 per cent in 2006. That's where the growth in the economy is coming from. The housing boom is not the cause of economic growth but the result of economic growth. The Irish housing market is far more tied to the U.K. housing market than to the U.S. housing market. House prices in the U.K. did fall during most of 2005, but the effect on Ireland was minimal. Since December 2005 they've been rising sharply again in the U.K. Even in the U.S. the fall is only expected to last from autumn 2006 until spring 2007. Minor market corrections such as happened in the U.K. in 2005 or in the U.S. between autumn 2006 and spring 2007 happen all the time in all markets and are no big deal. That's what free markets are all about, adjusting price to supply/demand. The fall in house prices in the U.K in 2005 didn't stop the U.K. economy growing and the current fall in house prices in the U.S. isn't stopping the U.S. economy growing or stopping U.S. unemployment falling. To extrapolate from these minor market corrections in specific sectors the mother of all crashes that will leave the economy reeling is totally DAFT. I guess that's why the site was so named. The ESRI house price index shows house prices rose in September by 0.7 per cent and by 10.9 per cent since the start of 2006.The last recession in Ireland was in 1983 - since then there have been countless predictions of an imminent recession, but all proved wrong. Your political motivation in trying to con the public into believing that a recession is imminent is abundantly clear from your website and is directly related to the fact that an election is also imminent. Its also abundantly clear that you simply long for such a recession in the hope that the resulting misery will bring about a political dividend. But, I'm afraid you're going to be disappointed.

Well, this guy is an expert, at least as expert as the original poster on this thread:

"Average house prices in Ireland will grow by around 7% per annum over the medium and long term, leading to a virtual doubling of prices over the next 12 years, according to the analysis of Dr Brian Lucey, Lecturer in Finance at Trinity College , Dublin ."

There are a miilion more such items on the internet. They outnumber those predicting a crash by a hundred to one.

I never suggested that anyone should buy a house to rent out to avoid a crash. I said that, if someone genuinely believes property prices in Ireland are about to crash, then the sensible thing for them to do would be to sell their house now before the crash and use part of it to rent a house instead of owning one. Its the fact that those predicting a crash aren't doing so that indicates they don't actually believe their own predictions. I emailed David McWilliams a few weeks ago offering to buy his house for 75 per cent of its current market value. I thought this was an extremely generous offer on my part, given that he'd just written an article predicting that Dublin house prices could fall by 50 per cent in the next year. But, he's declined my offer.

Ah, Dear John,

You've hit the nail on the head in some ways.

First off, I'd love you to acknowledge that extrapolation of current trends into the future is a futile exercise, no variable stays the same forever! Otherwise all those ads wouldn't carry the: "past performance no guide to future performance"!!!

And regarding population that is exactly the point, there is alot of interesting demographical data floating around out there at the minute designed to stave off bubble talk in some instances, again conveniently timed with an election upcoming (eh, John eh? Works both ways doesn't it?!) but the reality is this.

We're building a record number of houses, 1 house for every nine people versus the UK's 1 for every 32. Couple that with the demonstrated lack of ability for the Irish to soak up the ECB interest rate increases and again couple that with the fact that we have the 2nd highest level of personal debt in the first world and you begin to get a fuller picture.

Immigrants will rent houses yes. But it's kind of tough on the minimum wage to buy a dream 3 bed semi-d in the North County for example, thus Mr. Landlord comes into being. Now with rental yields the way they are, the only prospect that makes buying sense is the hope of some capital appreciation.

But if affordability kills off demand, what happens to price?

Manufacturing may be up 6% but it doesn't represent a major component of the Irish Economy, Services, Public Sector and Construction in that order is the Irish Economy. And cutting construction jobs to halt completions in an effort to keep price stable, as recommended by many an "expert" is likely to have some nasty effects, eh John?

Indeed you are correct John, the UK market is important perhaps more so than the US, no surprise that there have been significant reports of Irish investors heading to the UK to dump cash, what does that do to demand, eh? And what does that do to price!

You can't kid the fundamentals.

[i]"Your political motivation in trying to con the public into believing that a recession is imminent is abundantly clear from your website and is directly related to the fact that an election is also imminent. Its also abundantly clear that you simply long for such a recession in the hope that the resulting misery will bring about a political dividend. But, I'm afraid you're going to be disappointed."[/i]

I'd just like to make one point abundantly clear, I have a certain political view yes, but my views do not reflect the totality of the views of the users of thepropertypin because it's a discussion site! Please come on over John! The website was set up by another user to discuss the implications of the bubble, crisis or boom!

By the way, nobody longs for a recession John, only the most short-sighted reactionary!

Just had a longer look at your website. Congratulations on at least having such a well-presented site, very professional. Better than those that some of the political parties have. You're certainly very prolific with your predictions of doom, at least several every day. No clouds have silver linings in your world. Its all black, black, black. I'd need to dose myself on prozac before I could become a regular reader of it though, its just so depressing. On a minor point, none of your predictions have actually come true yet but, hey, the same could be said of David McWilliams and that hasn't stopped him.

Dr Brian Lucey's prediction of "7% per annum over the medium and long term" or of "doubling of prices over the next 12 years" (which is actually 5.9% per annum) is merely quoting the century average without any recognition of fluctuation, hysterical or otherwise. Prices could plummet by 30% next year and still rise entirely in line with this figure, causing no problems for the lifetime investor or for the established homeowner but kicking endebted recent buyers in the teeth. Two experts singing the same song to different tunes.

On risk-averse financial grounds I would have to sell my home and buy a mixed portfolio of equities, bonds and resources. The massive influx of new and returning migrants is a huge incentive to high risk, high gain investment though - but then why are all the financials disposing of their own property through sale and leaseback agreements, except risk-management?

The central bank aren't Irelands brashest announcers

of the endtimes but their reports have good

material for the immaterialists.

Between 1995 and inc the forecast for 2007; 735,000

new houses and apartments have been built - not inc

old houses renovated - and the total labour force is

only 2 million!! In the real world people already

can't afford these prices - you can work it out

easily. Mortgage of EUR350,OOO at 5.0% (which is where

mortgage rates are heading I think) = EUR17500

annually in interest, plus repaying it over 25 years =

350/25 = EUR14,000 annually in principal, totalling

EUR2,470 per month! Put mortgage rates at 5.5 and ts 2,750

per month...I could go on but basically

there is going to be a horror story crash.

In the UK prices fell for 3-4 years and then flattened

out but only recovered to 1990 peak levels by about

1997 - in central London - and later elsewhere. By

that time interest rates had dropped from 15% to 6%

and incomes - especially in London - had risen

sharply. So I think prices in Ireland are likely to

fall - though hard to tell by how much - and will take

years to recover. The ECB will hike rates again in

December to 3.5% and probably to 3.75% or 4% by mid

2007, as Germany is recovering strongly. Also the

Irish CB report stated that Irish competitiveness has

deteriorated sharply - so with the US slowing there

won't be much to replace housing as an engine of

growth.

You say in regard to UK in 1990s: 'By that time interest rates had dropped from 15% to ...'

You say in regard to Ireland: 'The ECB will hike rates again in December to 3.5% and

probably to 3.75% or 4% by mid 2007..'

Quite a difference between 15% interest rates and 4% interest rates.

In addition, interest rates will not stay at that rate. They'll probably only stay at their peak

rate for six months and by early 2008 should be falling again. In fact they may be

falling much earlier than that if the Northern Hemisphere has a mild winter (which

thankfully because of global warming is very possible) and oil prices fall to 40 dollars

a barrel in the Spring which many oil analysts are now predicting.

My wife and I, after rearing our children, sold our Dublin house in July and moved to the West. The twigger that made us do that was the sight of the major Banks selling off their branches. This to us was a fundamental sign as we guessed that they did their homework!

Well done John, 15 is much bigger than 5! The difference here is affordability, the chestnut to which all this returns. On 35grand a year which is the average, or a joint of 60-70 000, people are increasingly unable to afford mortgages at current rates. The cost of housing in london in the late 80'S was more affordable considering incomes at that time. The salient point is that it took a collpase in interest rates and an increase in real income to see property back to peak prices, and that only after several years.

"In addition, interest rates will not stay at that rate. They'll probably only stay at their peak

rate for six months and by early 2008 should be falling again". I dont know what youre basing this on. Seems, eventhough rate of euro growth has slowed, that there is only one direction for german and french economies to go. I dont see why the next period should not be one of rising rates as the last period has been one of falling interest rates.

As for the oil point, the price of oil has nothing to do with supply and very little to do with demand. It is a political question almost entirely as evidenced by fluctuations over the last 7 or 8 months. So a warm winter will have the same impact as the hurricanes taking out much of the gulf of mexico production last year, very little.

The London and broader UK market, throughout good times and bad, has returned very similar growth to the Irish market. The graph is about fluctuation around these "medium to long term" trends. Most people who lived through the UK housing boom made great returns when they ultimately sold their property, but some were caught badly - for instance anyone having urgent reasons for returning to Ireland.

What some people are doing with Irish property is like putting all your savings into a single stock and praying that it does a boo.com, and that you can predict the top of the cycle, and that there is some gullible investor around just when you need them. If you are in your home as a dwelling then you don't care. If you are in your home 12 years then you don't care.

But if you just put 400,000 into a small des-res appartment, then it would be awful inconvenient for interest rates to double your mortgage payments just as the tax-relieved glut of "student let" accomodation hits the starter home market in 2008.

From today's Irish Independent:

THE outlook for interest rate rises next year grew more confused yesterday when the eurozone economy slowed more than expected in the third quarter, and German investor sentiment fell again.

In a hint that the European Central Bank may not have to raise rates much further next year, Dutch central bank governor Nout Wellink said the "neutral" rate of interest in the eurozone may be lower than in the past.

Economists believe the ECB would like to get rates back to a neutral level. "What a neutral interest rate is changes over time. But it would not surprise me if this is now lower than it used to be," Mr Wellink said.

"We expect to see an economic slowdown in the first quarter and this is when the ECB will revise down its optimistic outlook for the Euro economy. We forecast a rate hike in March will be the last for 2007," said Christoph Weil, a senior economist at Commerzbank in Frankfurt.

Investor sentiment in Germany unexpectedly worsened in November to the lowest level since March 1993, according to the important ZEW institute's survey, as investors braced for the effect of a three percentage point interest rate increase.

---------------------------------------------------------------------------------------------------------------------

So, it looks like Euro interest rates aren't even going to hit 4 per cent, probably 3.75 per cent will be their limit, at least according to the Dutch and German bankers. The fundamental fact is that most of the EU economies are so bogged down with high taxes, rigid labour markets, anti-business governments, idiot left-wing and green politicians constantly trying to regulate everything that their economies grind to a halt once interest rates go much above 3 per cent. As you can see from above, its allready happening over there. Meantime

our economy goes from strength to strength. Just look at today's papers:

from today's Irish Examiner:

"the average household in Ireland will increase its spending on Christmas this year by 10 per cent, the highest in the EU -

spending will reach 1300 euros per household, double the EU average and higher than in the U.S."

from today's Irish Indepent:

"survey indicates employment in Irish businesses will surge in coming months"

from today's Irish Times:

"GOOGLE announce big expansion in Dublin and are increasing employment by 500

That's just from today's papers.

Over the past 12 months house prices in the UK and in N. Ireland have risen sharply even though their interest rates have been 4.5 per cent to 5 per cent throughout the year. So, if they can sustain house price increases with interest rates of 4.5 per cent to 5 per cent, I fail to see why Irish house prices should collapse because interest rates hit 3.75 per cent. All the more so as (a) our economy is doing far better than their's (7 per cent GNP growth here v 2.5 per cent there) (b) our real incomes are rising far faster than their's (c) our unemployment rate is falling while their's is rising (d) we can look forward to tax cuts in December while Gordon Brown is running a 50billion sterling deficit and having to put up taxes (e) we still have mortgage tax relief while Gordon Brown aboilished it over there (f) we have no annual property taxes while over there council taxes are soaring out of control (g) our population growth is 5 times their's.

Given all this, the only thing that will cause Irish house prices to crash is if that lunatic halfwit cretinous buffoon Islamic cleric, quoted in today's Irish Times as advocating that Dublin should be bombed like 9/11, has his way. I'll grant you that. So, let's just hope the Americans incinerate him before he has his way.

The irish economy has outperformed its neighbours withoout a doubt. But the point I was making earlier is about house price inflation and affordability for those entering the property market, those on whom the property market is built.

House price to income ratios in London are about 5 to one, elsewhere in the UK its more like 3.5 to one. There is quite a lot of room for house price inflation before they get near Irelands rate which is closer to 7 or even 10 to one depending on where you look.

"the average household in Ireland will increase its spending on Christmas this year by 10 per cent, the highest in the EU -" The papers didnt say how much of that 1300 per household will be spent using plastic. The debt-to-income ratio increased by 18.7 per cent in 2005 and is forecast for 20% by the end of this year. Thats just the increase in indebtedness to banks, credit unions and credit card companies over the past year! Its like the roaring '20s except worse cos everyone has mountains of unsecured debt.

"the only thing that will cause Irish house prices to crash is if that lunatic halfwit cretinous buffoon Islamic cleric..." or you get dollar depreciation as a result of washingtons ballooning current account deficit and a shrinking of US investment here, or you get fairly marginal depreciation in sterling against the euro making Ireland even more uncompetetive. There are countless vartiables out there to keep ones pace maker knocking at night.

According to the most recent ESRI house price tables (for September 2006), the average price of a house in Ireland was 308,179 euros and the average price of a house in Dublin was 419,809 euros.

According to the BBC website, the average price of a house in the U.K. (i.e. the whole U.K including England, Scotland, Wales and N. Ireland) is now £211,452 sterling and the average price of a house in the Greater London area is now £331,000 sterling. Converting these to euros gives approximately 310,000 euros for the U.K. as a whole and 485,000 euros for the Greater London area. If I had my calculator handy, I could have done the sterling to euro conversions precisely, but I haven't, so the euro figures for the U.K. are approximate)

Making comparisons, the average house price in Ireland is about the same as in the U.K (308,179 euros in Ireland v approximately 310,000 euros in the U.K.) . House prices are higher in Ireland than in the depressed regions of the U.K. like the North, Scotland, Wales, and N. Ireland but lower in Ireland than in the more prosperous regions of the U.K. like the South-East and Greater London. In fact, if the British Isles (and I use the term only for convenience here) were split up into regions, the Rep. Ireland would only come about halfway up the table for average house prices. According to the same BBC website, the average price of a house in the the South-West of England (by no means the most prosperous part of England) was £217,222 sterling which converts to approximately 320,000 euros, in other words about the same as in the Rep. Ireland (actually slightly higher). Comparing the cities of Dublin and London, rather than comparing countries, house prices are on average about 15 per cent higher in Greater London (that's Greater London, not just the small bit in central London).

Interest rates are about 50 per cent higher in the U.K. (5% in U.K. v 3.25% in Ireland) and the U.K. no longer has mortgage tax relief, while Ireland has. GNP per capita is about the same in Ireland and the U.K. and average after-tax incomes are about the same.

Consequently, your claim that houses are twice as affordable in the U.K. as in Ireland are absurd. In both countries average house prices and average incomes are about the same (as shown above), but interest rates are far lower in Ireland and mortgage-payers in Ireland get tax relief on mortgage payments while their conterparts in the U.K. don't.

========================================================================

Regarding your claims on uncompetitiveness, from today's Irish Times website reporting the announcement of the GOOGLE expansion:

"John Herlihy, European director of sales and operations at Google, said that he wished he could find more locations like Dublin. Mr Herlihy said the Dublin office was expanding and that a huge range of languages and skills were required to support potential customers from the Urals to the Cape in Africa."

"He also dismissed the idea that costs were excessively high in Ireland. He said many Nordic countries, London and Germany were all higher than Dublin in terms of costs."

"He added that the skills set available to companies like Google in Ireland were a significant consideration as well as the low corporate tax rate."

So, he doesn't agree with you, but then what does he know? He just runs GOOGLE in Europe.

========================================================================

Stop deceiving yourself that your claims of imminent economic catastrophe are based on solid statistical analysis. They're not. You simply detest the present government (which you're perfectly entitled to do), are desperate for them to lose office in May (which you're perfectly entitled to want) and this is leading you (maybe even subconsciously) to make predictions that you believe will increase the chances of that happening. Not criticising you for that. We all do it, in lots of different spheres of life. I'd probably be doing similar if a socialist government was in power here. I'm a Man Utd supporter, I hate Chelsea and I regularly convince myself after 'analysing' all the results and league tables that Chelsea are about to implode. You're doing much the same with the Irish economy.

Must go now. Off to Lansdowne Road. Late allready. No doubt that, given your usual level of pessimism, you're convinced that San Marino will beat Ireland tonight. Actually, I think there's a much greater chance of that happening than the Irish economy and property markets collapsing.

We could debate the stats ad nauseum - interest rates, emigrants (and the sector they are employed in), vacant apts\houses, rate of new builds, the average cost of a house vs what the average consumer can afford, etc. Instead look at it this way - when everyone is debating the market almost every day I'm reminded of my thoughts during the internet bubble and it's crash. It was just as Joseph Kennedy (John F's daddy) predicted: “When the shoe-shine guy gives you stock tips, it’s time to get out.”. He made that comment after cashing in his shares just before the Great Depression and stayed a wealthy man.

Look at this and sober up: http://www.cjseymour.plus.com/finan/prognost.htm

And before the bulls return with "But that's the stock market, not land". It's still a market and can teach us a thing or two. Besides if all was well why are you taking the time to argue?

Unlike previous warning's that the Irish property market was going to crash, this time it is backed by solid data which clearly indicates the Irish economy has become unbalanced and will experience an economic recession, mainly as a result of a downturn in the construction sector and excess debt, but also econmic problems of external trading partners such as the USA. The property market in Ireland manifests every, and I mean EVERY trait of a classic asset bubble. Don't take the doomsayers word for it, they have not been able to time any downturn to date, go look at the data and make up your own mind as regards the short to medium term trends of this particular sector of the economy (23% of 2005 GNP) and its underpinnings.

Construction and Housing in Ireland July 2006

http://www.cso.ie/releasespublications/documents/constr...g.pdf

Central Bank & Financial Services Authority of Ireland Financial Stabilty Report 2006

http://www.centralbank.ie/data/FinStaRepFiles/Part%201%...6.pdf

Irish Property Boom - It's easy to underestimate how much economic prosperity depends on it

By Michael Hennigan, Editor and Founder of Finfacts, Nov 6, 2006

http://www.finfacts.com/irelandbusinessnews/publish/art...shtml

The Irish Property Review A Quarterly Analysis – November 2006

Dr. Dan McLaughlin, Chief Economist Bank of Ireland

http://www.bankofireland.ie/html/gws/includes/personal/...6.pdf

Irish property: government finances exposed to a correction - October 2006

By Rossa White

http://www.davydirect.ie/other/pubarticles/irishpropert...6.pdf

IBF/PwC Mortgage Market Profile New Lending - Quarterly Report (Q2-2005 to Q2-2006)

http://www.ibf.ie/pdfs/ibf_pwc_mortgage.pdf

Construction and Housing in Ireland Report: CSO says Construction Output up 80% in 5 years - Mortgage debt increased from €33bn in 2000 to €100bn in 2005

http://www.finfacts.com/irelandbusinessnews/publish/art...shtml

Key workers can't afford houses in main cities - September 2006

http://www.rte.ie/business/2006/0920/housing.html

Department of the Environment, Heritage & Local Government Construction Industry and housing Statistics

http://www.environ.ie/DOEI/DOEIPub.nsf/wvNavView/Regula...en#I2

Buy-to-let yields at a historic low

http://www.timesonline.co.uk/newspaper/0,,2771-2307853,....html

Daft.ie Q3 2006 report

http://www.daft.ie/report/pat-mcardle.daft

The Time of Our Lives? Ireland '86-'06

http://www.rte.ie/thetimeofourlives/boom.html [realplayer required]

Primetime - Fears of slow-down in housing market

http://dynamic.rte.ie/av/230-2183980.smil [realplayer required]

Irish Forum GlobalHousepricescrash.com

There is more than a hint of emotion in the discussion of house prices, and far too much cherry-picking of bijou factets to suit any particular conclusion. House prices rise and fall (but not nearly so neatly as the pretty graph) around some notion of affordability, and it isn't unreasonable to say Irish house prices are currently 15% over and might be 15% under at some point in the next few years. I had the same opinion 5 years ago and the market has gone on rising, but I would still say it.

If you hold your home for a decade then you can expect affordability to approximately double, and a 30% downturn still leaves you a comfortable 70% better off, which is 5.5% per annum growth. That beats a savings account even in what many commentators are calling a doomsday scenario. And that is buying high and selling low - the other way round would be nice. Any doomsday would affect those wanting to move and those wanting to increase their borrowings on negative equity, with a general gloom permeating all consumer economic activity.

But if you want the money, why not buy shares in Abbey or Kingspan with 1% duty and 2% commission, and the ability to invest and realise profits at a moments notice? Or better still buy shares in Blackrock which, at least until its first set of results or non-Fyffes let, is on a completely arbitrary valuation plucked out of the air when it floated.

I remember when boo.com crashed with equally emotional (and some very rich) investors cherry-picking their rosy news. The report on CNN News had the company logo on a backdrop, reflected on the glass of the newsreader's desk like this:

boo.com

poo.cow

So you admit that all previous predictions of imminent crash made over the past 15 years have proved false. You also admit that you are unable to give us any clue as to the date on which the crash you now predict will commence. Imagine if the situation was the other way round. Suppose we'd had 15 years of recession since the early 90s. Suppose that during those 15 years of recession the Taoiseaxh had popped every Christmas and said 'the recession is about to end, we're going to have a boom'. And he'd been wrong 15 years in a row. And then suppose this year, with the election looming, he popped up and said 'Yes, I know I've been wrong 15 years in a row, but this time I'm right and there's definitely, definitely going to be a boom, although I am unable to give you any inkling as to when it will commence'. He'd be laughed out of sight.

Simpleton talks much more sense than the doom-mongers here who are much more deserving of the term 'simpleton'. Let's suppose, for the sake or argument, that house prices in Ireland are 15% over-valued. It doesn't mean that they will fall by that amount. As after-tax incomes are rising by 5% to 6% annually in Ireland, over the next 5 years we can expect them to rise by about 35%. Therefore, to correct the 15% over-valuation, all that is required is for the rate of house price increase to fall to around 3% annually. That's entirely possible. But, that's not a crash, merely a minor correction in the market, which happens all the time for all products and for all commodities.

It's the composition of the market my dear friend.

Take a look at the title of this thread, low yields are turning off investors... Recent figures show that about 60% of mortgages issued this past 12 months have gone to a combination of investors and people refinancing (which might very well be people investing on the downlow as it were), then you add in the statistic that 4 out of every 10 new mortgages issued has been interest only and you get to a very interesting situation.

We know that a quarter of a million homes lie vacant in this land, a conservative guess places half of those in the holiday home category and we are left with approximately 125,000 homes bought on the basis of pure investment for capital appreciation.

Even a moderate stall in prices could make those investors nervous and what with DAFT and others recording record inventory, a doubling of inventory on the books in the last three months, that points to people looking to realise value for their investment at the top of the market.

They've seen the signs, AIB sold a large portion of it's own property portfolio in April of this year they're not taking any chances, affordability is tanking and it's not because of stamp duty predictions, it's because of our historically low interest rates going up and we have no control over them.

So a rush to the door creates it's own dynamic.

Squeezing supply to hold prices at an artificial level will cause a recession, what else would happen with the tax take massively reduced and a 100,000 suddenly out of work from construction that would reduce demand for the remaining 70% employed in services. It's a vicious circle.

Ireland, I repeat, has the 2nd highest level of personal debt in the first world.

For every €1 earned, there is €1.20 already out there lent to somebody.

Ever hear of gearing? This country is heading for a crash.

No its not. No organisation of any standing predicts anything other than growth for years ahead in Ireland. The EU don't. The OECD don't. The IMF don't. The World Bank don't. The Central Bank doesn't. The Bank of Ireland doesn't. AIB don't. ESRI doesn't. Davy stockbrokers don't. Goodbody stockbrokers don't. The British banks in their forecasts for Ireland don't. You may say that all these organisations know nothing and that only you know what's in store. Like some religious nut, who's convinced the world is about to end and can't understand why nobody else follows him up to the the top of the mountain to witness it. But, please please, I beg you, don't let me stop you making your doom-laden predictions. Keep churning them out, the more the merrier, because the more you churn out, the more silly you'll look in a year's time. Although, since all your activity in regard to doom-mongering is directly related to the coming election, I have no doubt but that you'll pack it in once that election is over and you've failed to achieve the political breakthrough for the cause of loony left environmentalism that you so obviously crave.

"Ireland, I repeat, has the 2nd highest level of personal debt in the first world.

For every €1 earned, there is €1.20 already out there lent to somebody.

Ever hear of gearing? This country is heading for a crash."

High gearing doesn't cause crashes. As long as we can afford to repay the cash, it is of practically zero relevance to the future prospects of the economy. Just because we are all paying for everything with someone else's money is no reason to be pessimistic. And with interest rates still low, who cares if we are borrowing stacks of cash? It's cheap. And will continue to remain so, in relative terms, no matter how many rate rises we see in the next year or so. What's the fixation with debt? Look at every business in the world, they are all in debt. It's just an efficient use of money to be highly geared, that's all.

"But if affordability kills off demand, what happens to price?"

Demand won't be killed off. It will remain the same. The people will still want houses (that's demand, which you are mixing up with transactions realised) even if they can't afford them. So what will happen? The prices will come back down to the level where people can afford them again. That's not a crash either. It just means the small amount of people who bought in between the level most people can afford and the ceiling level will lose some money. So what?

"They've seen the signs, AIB sold a large portion of it's own property portfolio in April of this year they're not taking any chances"

That's the biggest red herring of them all - "the banks are getting out, so that must mean we're all fucked!!!" AIB is a bank, not a property speculator. It's business is to lend to people who want property, not to own property itself. It was restructuring its balance sheet to make a more efficient use of its assets. It means nothing.

I love the roll call John does there, that's brilliant.

The fact that I trip out the exact same listing of institutions and experts all warning that property in Ireland is seriously over-valued and to quote Fitch, the international risk rating specialists, we're in line for some "macro-prudential stress".

When is a crash, not a crash? When it's "macro-prudential" stress? Come on in, the macro-prudential stress is lovely...

And then the latest poster, sorry mate, didn't catch your handle! Less of the sensationalism, AIB dumping property a "red herring" because they're not a property speculator... Indeed, you've made my point for me my dear boy... The Irish Property Bubble hasn't suckered the ones or twos ins, it's suckered thousands of amateur investors and they are probably far less adept than a bank with a properly managed property portfolio, eh!

But, sure it's only a few who'll lose their shirts and they deserve it!

Great stuff.

I think you have to bear in mind that Irish interest rates are rising from 2% to as high as 4% by next summer, but people who have bought are geared for super low rates. Also there has been vastly more supply in Ireland while supply in Dublin is much more limited. GDP per cap in

Ireland is pretty high but is more highly skewed than in the UK, especially London, so median incomes are lower. I think it may also be biased upwards by companies declaring profits at 12% tax in Ireland. Business people pay v low tax with corporate taxes at 12% but salaried people make much less than in London.

How many people do you know earning £100,000 plus? For example something like

350,000 people work in the City where incomes are very high and tens of thousands of people earn 6 fig bonues and upwards. Then there is also the influx of foreign money with eg rich Russians and middle easterners buying homes there, so I think London prices should be considerably higher than Dublin, which should be closer to eg Manchester (50% cheaper than dublin). Some high earners feel they are being priced out of the London market with 2 bed flats about £1mn in the nice areas but I have no idea who can afford the EUR1mn+ flats in Dublin - except those of course who have already made a bomb in property. I actually think its pretty scary that Dublin prices are just 15% lower than London's.

Im sure Ireland will win the european cup.

sceptics unite!

Or better still buy shares in Blackrock which, at least until its first set of results or non-Fyffes let, is on a completely arbitrary valuation plucked out of the air when it floated.

Anyone who took my advice on 16 November would now have a profit of 40% (53 cent now versus 38 cent when I wrote it) on Blackrock shares, or a more modest 20% on Fyffes itself - not bad for a couple of months with minimal effort.

Still interested in playing the property market John? Switch to Qualceram, which is well-valued in any case but likely to reap a huge windfall from property sales, not least a huge site in Arklow with great development potential. Don't mortgage your home to play though, sentiment has no economic value.

Jaysus, this sh*te was prescient what!!!

Holy mother o'jaysus...

Wow. John and Simpleton, you two do look silly now. Eh?

"High gearing doesn't cause crashes. As long as we can afford to repay the cash, it is of practically zero relevance to the future prospects of the economy."

"As long as we can afford...". Indeed.

Well, as a nation, we're going to pay for disaster for a long time. The entire nation now has high gearing through the guarantee and the IMF/EU bailout. The jury is still out on if we can afford it.

It's very interesting reading John's contributions above. It's like being able to read the mind of a dinosaur. I remember him telling me, on this site, that Irish companies have no need of venture capital - as they can always get cheap and easy credit.