Parse failure for https://anti-empire.com/feed/. Last Retry Wednesday January 07, 2026 00:09

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

UCC has paid huge sums to a criminal professor

This story is not for republication. I bear responsibility for the things I write. I have read the guidelines and understand that I must not write anything untrue, and I won't.

This is a public interest story about a complete failure of governance and management at UCC.

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Socratic Dialog Between ChatGPT-5 and Mind Agent Reveals Fatal and Deliberate 'Design by Construction' Flaw

This design flaw in ChatGPT-5's default epistemic mode subverts what the much touted ChatGPT-5 can do... so long as the flaw is not tickled, any usage should be fine---The epistemological question is: how would anyone in the public, includes you reading this (since no one is all knowing), in an unfamiliar domain know whether or not the flaw has been tickled when seeking information or understanding of a domain without prior knowledge of that domain???!

This analysis is a pretty unique and significant contribution to the space of empirical evaluation of LLMs that exist in AI public world... at least thus far, as far as I am aware! For what it's worth--as if anyone in the ChatGPT universe cares as they pile up on using the "PhD level scholar in your pocket".

According to GPT-5, and according to my tests, this flaw exists in all LLMs... What is revealing is the deduction GPT-5 made: Why ?design choice? starts looking like ?deliberate flaw?.

People are paying $200 a month to not just ChatGPT, but all major LLMs have similar Pro pricing! I bet they, like the normal user of free ChatGPT, stay in LLM's default mode where the flaw manifests itself. As it did in this evaluation.

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

Evaluating Semantic Reasoning Capability of AI Chatbot on Ontologically Deep Abstract (bias neutral) Thought

I have been evaluating AI Chatbot agents for their epistemic limits over the past two months, and have tested all major AI Agents, ChatGPT, Grok, Claude, Perplexity, and DeepSeek, for their epistemic limits and their negative impact as information gate-keepers.... Today I decided to test for how AI could be the boon for humanity in other positive areas, such as in completely abstract realms, such as metaphysical thought. Meaning, I wanted to test the LLMs for Positives beyond what most researchers benchmark these for, or have expressed in the approx. 2500 Turing tests in Humanity?s Last Exam.. And I chose as my first candidate, Google DeepMind's Gemini as I had not evaluated it before on anything.

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

We have all known it for over 2 years that it is a genocide in Gaza

Israeli human rights group B'Tselem has finally admitted what everyone else outside Israel has known for two years is that the Israeli state is carrying out a genocide in Gaza

Western governments like the USA are complicit in it as they have been supplying the huge bombs and missiles used by Israel and dropped on innocent civilians in Gaza. One phone call from the USA regime could have ended it at any point. However many other countries are complicity with their tacit approval and neighboring Arab countries have been pretty spinless too in their support

With the release of this report titled: Our Genocide -there is a good chance this will make it okay for more people within Israel itself to speak out and do something about it despite the fact that many there are actually in support of the Gaza

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

This story is unverified but it is very instructive of what will happen when cash is removed

THIS STORY IS UNVERIFIED BUT PLEASE WATCH THE VIDEO OR READ THE TRANSCRIPT AS IT GIVES AN VERY GOOD IDEA OF WHAT A CASHLESS SOCIETY WILL LOOK LIKE. And it ain't pretty

A single video report has come out of China claiming China's biggest cities are now cashless, not by choice, but by force. The report goes on to claim ATMs have gone dark, vaults are being emptied. And overnight (July 20 into 21), the digital yuan is the only currency allowed. The Saker >>

Interested in maladministration. Estd. 2005

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

Joe Duffy is dishonest and untrustworthy Anthony Joe Duffy is dishonest and untrustworthy Anthony

Robert Watt complaint: Time for decision by SIPO Anthony Robert Watt complaint: Time for decision by SIPO Anthony

RTE in breach of its own editorial principles Anthony RTE in breach of its own editorial principles Anthony

Waiting for SIPO Anthony Waiting for SIPO Anthony Public Inquiry >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Human Rights in Ireland >>

|

Tax Breaks for Commercial Property Will Fuel Bubble

national |

economics and finance |

feature national |

economics and finance |

feature

Thursday November 24, 2016 03:56 Thursday November 24, 2016 03:56 by 1 of Indymedia by 1 of Indymedia

Original article by Stephen Donnelly TD

We are republishing this article by Stephen Donnelly TD who has been doing great work in exposing how Fine Gael have gone out of their away to facilitate vulture funds who are now preying on ordinary people by charging exorbitant rents and fueling the current property and are replacing the English absentee landlord of centuries past, with ruthless vulture funds capitalists of this era and essentially introducing a form of neo-fuedalism as increasing huge swaths of the population are either priced out of buying homes, or are signing up for debt that last close to a lifetime.

Related Links:

Stephen Donnelly, TD submission for a detailed proposal to target €20bn in future avoided taxes. |

Update on the work of NAMAleaks.com

Proposed new tax breaks in the Finance Bill will fuel an existing commercial property bubble in Dublin.

They’ll do this by making commercial property investment, mainly by large foreign landlords, entirely tax free. This will drive up commercial rents, suppress residential development, put Irish banks at risk, and deprive the State of much-needed funds.

As far as I can tell, no other European country offers a tax-free environment on commercial property.

And in light of our recent property bubble, fuelled by foreign capital, it’s difficult to understand why it’s being proposed.

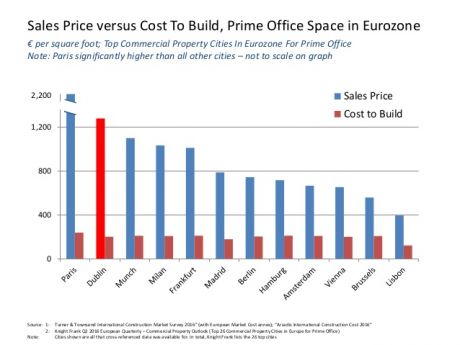

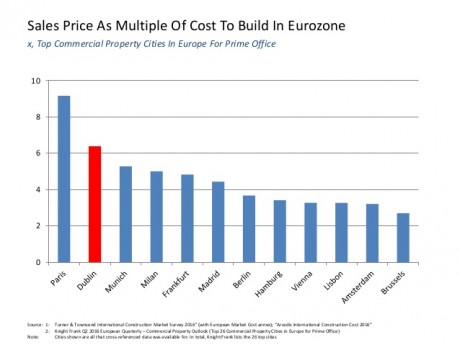

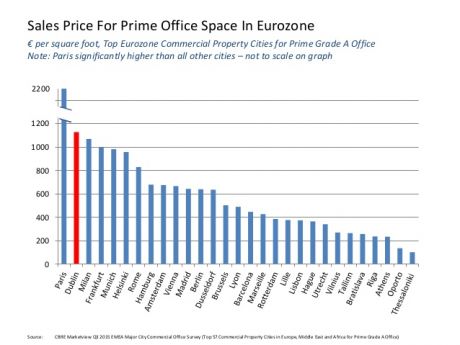

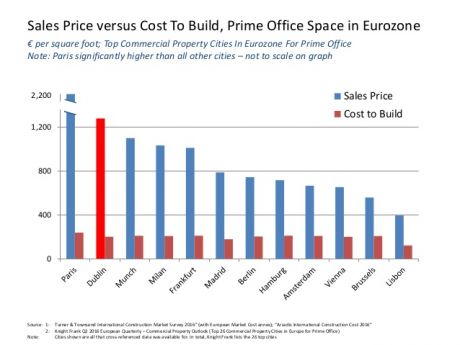

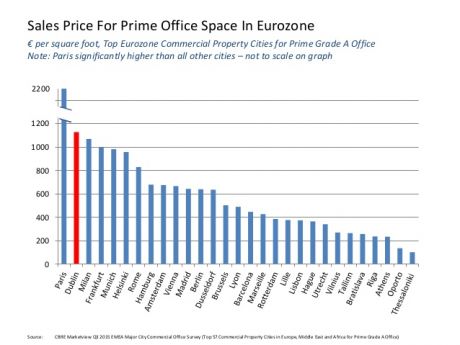

Particularly because we already have a bubble in commercial property in Dublin. Surveys by CBRE and Knight Frank show Dublin to be the second most expensive city in the Eurozone to buy high-quality office property.

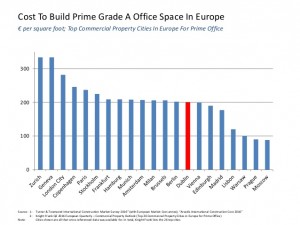

This isn’t due to build costs – international surveyors provide comparative data showing Dublin build costs in line with other Eurozone countries.

It isn’t due to demographic or geographic pressures – Dublin’s population density is low, and the city is surrounded by suitable development land.

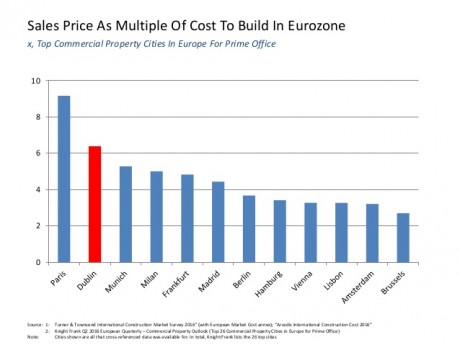

And yet, grade-A commercial property currently sells for 6.4 times more than it costs to build.

In Europe, only Paris and London have higher multiples. And that, in anyone’s book, is a bubble. Well, almost anyone’s.

Commercial Property from Stephen Donnelly

Large real estate agents who sell commercial property are paid as a percentage of sales price. So high volumes of sales, at high prices, make them a lot of money. Some will insist there’s no bubble, that it makes perfect sense for this small city on the edge of Europe to have some of the highest prices on Earth.

They’ll point to yields from commercial property as being very reasonable. Exactly the arguments we’ve heard before, from about 2004 to 2008. This bubble damages the economy. Commercial rents have been spiralling in the capital, nearly doubling in the past two years. That’s bad for business, and bad for consumers. Residential development is being suppressed. Right now, decent commercial property in Dublin is selling for more than €1,200 a sq ft, while residential property sells for about €500 a sq ft.

So naturally, developers and owners of zoned land are highly incentivised to build offices, rather than homes.

The bubble also puts the Irish banks at risk. There are numerous new safety valves in place since the Crash, but the last thing anyone wants is for our domestic banks to be lending into another property bubble.

Part of what’s driving this bubble is a raft of recent tax breaks.

Real Estate Investment Trusts (REITs) were introduced in the 2013 Finance Act.

As one international fund puts it on their website, Irish REITS, “unlike other property companies, distribute their income in a highly tax-efficient manner”.

Irish Collective Asset-Management Vehicles, ICAVs, were introduced in 2015.

They are described as follows by a leading law firm: “The ICAV is treated, for Irish tax purposes, as a corporate vehicle which is fully exempt from Irish tax on its income and profits.”

Qualified Investment Funds (QIF) are another legal vehicle used by property investors to ensure tax efficiency, allowing profits be rolled up for several years.

And Section 110 status is used by many so-called vulture funds to lawfully pay minimal or no taxes in Ireland.

What the lawyers and accountants have figured out is that if you combine various tax-efficient mechanisms (let’s say a QIF with a Section 110, or an ICAV with non-domiciled status), then property investors can move from being tax efficient to completely tax-free.

The Finance Bill should be targeting this behaviour to ensure taxes are paid, rather than avoided. Up to now, commercial property in Ireland hasn’t generally been marketed to foreign landlords as tax free.

Many people in the sector believe that, while tax-free status might be possible, it’s not what was intended.

But that’s all about to change.

The Finance Bill creates a new legal classification known as an Irish Real Estate Fund, IREF.

Once investors hold property for five years, they’ll be exempt from all capital gains taxes. It goes on to state that IREFs will, however, pay 20pc dividend withholding tax, DWT. However, it then exempts from this almost every domestic and foreign landlord who buys Irish commercial property.

The era of the so-called vulture funds is coming to an end, as the ECB’s negative yields policy has made most EU real estate too expensive for them. According to CBRE, more than 80pc of all future Irish commercial property investment will come from foreign pension funds, life assurance funds and other Collective Investment Undertakings (CIUs) which includes REITs. All of these will be exempt from DWT.

Irish pension funds are already exempt from taxes in Ireland. However, notwithstanding some exceptions, they don’t get exemptions from taxes when they invest in other countries. Generally, countries don’t give tax breaks to each other’s pension funds, and DWT cannot be reclaimed. It’s unclear then, why Ireland would now choose to give such tax breaks to foreign pension funds investing here.

Similarly, Irish life assurance companies were never exempt from Irish taxes. They do make use of tax deferral mechanisms such as QIFs, but pay their taxes at exit from those schemes.

But not for long. The Finance Bill makes genuine efforts to stop tax avoidance by the so-called vulture funds. This could bring in €10 to €20bn in new taxes to the State in the coming decade. Industry sources working with the vulture funds are confident they can still bypass these new measures, but some additional changes can make this much more difficult. However, it would be a great tragedy to win the battle and lose the war.

As it stands, the Finance Bill will effectively take commercial property, one of our biggest asset classes (possibly our biggest), outside the tax net. There’s no obvious reason for doing this. Other countries don’t. We’re already experiencing a bubble. It’s making things worse for the business community and for people looking to buy homes.

It would cost the State billions in coming years in foregone taxes.

|

national |

economics and finance |

feature

national |

economics and finance |

feature

Thursday November 24, 2016 03:56

Thursday November 24, 2016 03:56 by 1 of Indymedia

by 1 of Indymedia

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter