Initial Thoughts on the Govt's Guarantee to Irish Banks and Its Wider Implications

national |

anti-capitalism |

opinion/analysis

national |

anti-capitalism |

opinion/analysis  Friday October 03, 2008 00:22

Friday October 03, 2008 00:22 by Terence

by Terence

The Irish Plan in relation to the rest of the World

The article below presents some initial thoughts on the Irish govt's plan to support the banks up to 400 billion euro and its wider implications an whether it can help solve the crisis or just solve it for Ireland alone.

At first sight the plan by the Irish government to back the deposits in the Irish banks and now possibly non-Irish banks operating in Ireland seems like quite a clever reaction to the crisis.

Clearly, Ireland does not have 500 billion Euro in the event of a payout, given that our GDP ranges from 150 to 190 billion depending on what figures you use. Considering that approximately 16 billion Euros is spent for the entire Dept of Health budget per year in Ireland, it gives some idea of how big 500 billion is. Would we forgo the equivalent of our health budget for 30 years to pay this off?

The plan is clever because by extending the promise to all Irish banks it stopped the focus falling on any one particular bank and made the entire set more stable. As an analogy, kicking one (rotten) leg away from a stool can make it unstable, but in the equivalent scenario of this plan, you now have to remove all legs at the same time.

Obviously the government is assuming that this money will never been paid out and I would assume in the worst case scenario, they don't even envisage more than a few billion being paid out.

So what's the downside? The underlying assumptions would seem to be that since we are a small country, we can get away with doing our own thing because in terms of the overall global economy, we are just tiny. So on the one hand, we are told we are part of the global economy and apparently did well out of it, but that we are at the mercy of it, which happens to be a good way of taking any blame for economic problems off the shoulders of government and onto these mysterious global "factors". But the underlying assumption of this plan is that we are going to solve the problems here ourselves. But if it is true that global factors really do affect our economy then it is surely true that any internal solution that we devise interacts with these factors in some way, and therefore it is impossible, despite our desires, to isolate the factors internally.

Already we saw this kicking into effect when the Ulster Bank was left out of the deal and lets face it, the initial plan did amount to an unfair playing field, because such a massive promise was always going to start drawing funds in from aboard into Irish banks. The attraction of new deposits had to be at least half of the plan. The reason is that for some of the Irish banks the ratios of deposits to loans was too high and by increasing the deposits through this very attractive scheme, those ratios could be lowered and therefore bring those banks back into much safer territory. Obviously in terms of the percentage of deposits available throughout the UK and the rest of Europe, we would really only need a small percentage of the total to boost our deposit-loan ratios higher. The problem is that it is at the expense of the other countries' economies.

This has put the spotlight on all the other countries, where the banks will be looking for similar action, but if you simply scale things up, the figures would just become astronomical. It is not quite the same as the USA, where the government is simply paying off the banks debts, the Irish plan, if adopted by the rest of the EU, would effectively nationalise all the banks with the backing of the taxpayers except it would far exceed the ability of the tax payer to pay. In both the USA plan and to a lesser extent the Irish plan, if stability did return, then it simply allows the return of business as usual and the same insane levels of debt would soon return. After all that's why the loan-to-deposit ratios were so high. All talk about regulation and so forth is just groundless, because if there was any period of stability, the voices would soon return to free "business" the burden of red-tape and

regulation. The other difference and positive aspect of the Irish plan is that the banks would have to pay back the money. But is this realistic? If there is another crisis and the government pays out anywhere from say 1 billion to say 10 billion, the banks might manage it, but if the figure were to rise into the 50 or 100s of billions, I can't see the banks ever paying that back even if they wanted to and they wouldn't. It is clear then that the Irish plan would kind of work for Ireland and buy us enough time, so long as the rest of world somehow sorts out the problem in the meantime. But can it?

If we look at the scenario where we are the only ones adopting this plan and the other EU countries don't then, deposits will pour into the Irish banks and other banks situated here. If the figures get big enough, it could suck enough money out of the other countries to such an extent to start making their own deposit-to-loans ratios worse thereby increasing the instability in the rest of the EU which would ultimately come back and bite us, increasing the probability that the government would have to pay up the huge figures that they say they would pay. Now every banker, dealer and economist worth his salt knows that in that scenario the Irish govt would be unable to pay and basically default. For any sizeable amount of money would have to be borrowed since we don't have that sort of money lying around. Faith in the Irish economy and market would plummet and suddenly people who have their money here and transferred it here, would begin to wonder whether it is really safe after all. In that scenario it would be time to take it out again before anyone else does and we would be back to the same point that gave rise to the plan in the first place. If we had our own currency instead of the Euro, we could just print money, but that would be a fiat money supply and its value would plummet. With the Euro, we would have to borrow the money from Europe presumably from the very people whose instability we increased. So ultimately the plan only works if the rest of the world recovers.

It is easy to imagine the extreme cases when pondering the future especially when a crisis is in full flow, but normally the situation is more subtle and complex with more factors in play than sometimes realized and this would be why the future often unfolds in rather different and less extreme ways. Thats not to say extreme things don't happen. They do; just look at history. So the key determinants in the above scenario is how much or to what extent will the Irish banking plan influence or affect the wider EU economy? The govt is hoping not at all.

It should be recognised what is happening in the global economy is extreme and preserving the basic mechanisms that enabled it to arise, must mean it can only get worse. The question then is do any of these plans address or reverse these mechanisms or progression of events? The answer would seem no. This doesn't rule out these various bailouts can temporarily alleviate things but the problems still remain with the potential to arise again later.

It can be tempting to conclude that there is just one simple underlying problem but it is really a collection of problems. By that argument it is a good idea to analyse the problem through different perspectives, whether it be a political capitalist-class war analysis, a purely monetary analysis, criminal analysis, energy and resource analysis or any other types.

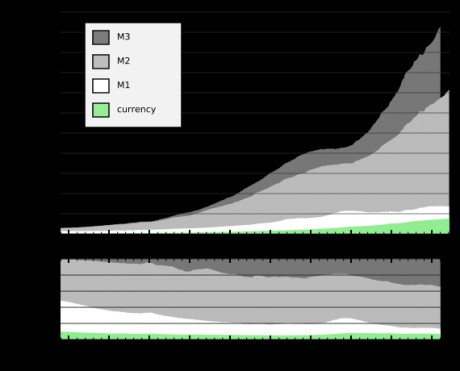

A brief take on these is that if you read what Michael Hudson (http://www.michael-hudson.com/) has to say then there is definitely a capitalist class war element to it and the various Socialist parties of all types would conclude this too. Looking at it through a financial lens, the level of debt has risen enormously and the ratios of loans to deposits has grown far too high. This is the leveraging argument with the observation that it now works in reverse where the amplification factor you get by leveraging applies to losses too on the way down. Straddling both of these domains is the observation that average wages (adjusted for inflation) have stagnated, and to maintain standards of living, workers have borrowed to maintain standards usually by borrowing against the "increasing" value of their homes. On the banking-business side they have been more than happy to make these loans because they have to keep people buying stuff in order to maintain growth and profits rates. And over the years as it has become clear these loans could not be made under "normal" standards, the response has been to loosen them and then largely do away with any standards for making loans. The same has applied to businesses and corporations. And this brings us neatly to the criminal analysis whereby Wall Street made such loans knowing they could never be paid back and got their colleagues to fraudulently rate them as excellent and sold them to financial institutions all around the world. A simple view of the Irish economy would say that we got caught up in the whirlwind and the property boom was a result of the easy money (i.e. easy loans) and to stay competitive, the banks here had to take the same risks. The easy credit largely originated in the US in response to the dot.com bubble implosion, to help avoid a recession. It is inconceivable though that many of the so-called intelligent people were not aware of the downside. They just didn't do anything about it for whatever reason whether to not rock the boat, were making money themselves, just too scared or maybe ignored and castigated.

Moving on into a purely monetary or currency view, the present problem actually goes back to 1972 when up to that point the dollar was referenced to gold. What happened is that the USA blew so much money on the Vietnam war that they were essentially broke, and the big powers in Europe like UK, France, Germany and Italy started asking and getting gold in exchange for the dollars that they held. As their gold reserves were rapidly depleted, Nixon made the dramatic move of simply declaring it no longer applied. There was not a darn thing anyone could do. America was still the world power both economically and militarily. Gold then was about $30 dollars to the ounce then. Over the years they just kept creating dollars and countries kept accepting them for products sold. During the first Oil Crisis, when the price of oil shot up and oil could only be bought with dollars, the need to have dollars to buy oil meant a steady and stable demand was present. In the meantime the price of gold while spiking at various points, about 4 or 5 years ago was trading at $350 to an ounce. What this tells you is that the dollar still informally tracked gold and in a sense your dollar was worth 10 times less than the one in 1972 relative to gold. As many people know, in the past decade China, Japan and various other countries have built up 100s of billions of dollars as a result of all the stuff they have sold to the US, but the US has gone past the point where it can possibly ever balance this trade deficit. Collectively foreigners hold trillions of dollars. This money to pay for these goods was in fact digitally created in the bank IT systems. It doesn't really exist. They are just IOUs. But everyone at the banking-governmental level knew this for the past 20 or 30 years, except it has got to ridiculous proportions now. Really the dollar is on the cusp on hyperinflation. So why in Europe or Ireland do we care. Its not our problem. Actually it is because the dollar is a world currency and any ructions there affects every other currency which is pegged to it. And the thing is all the currencies are pegged relative to it in one form or another. So the Euro is not ready to take over. If it was, it probably would have done so. There's lots of talk about referencing against a basket of currencies but it still doesn't get away from the central problem of tying money to something absolute rather than letting in float in thin air.

The Irish bank plan and all the other bailouts in the various guises are essentially a form of linking the currency not against gold but against or rather on the back of the tax payer. In some ways its not bad. Indeed centuries ago you could say money was referenced against both gold and the labour of peasants in whatever empire we might wish to examine. This takes us straight back to the domain of politics into areas like freedom and fascism and police states.

Thinking about currency also takes us in another direction, in terms of analysing the problem in terms of resources. What has not been said is that the increased amounts of money (of all currencies) in the world over the last 6 or 7 decades is also related to energy, in particular cheap energy, as represented by oil. The abundance of cheap oil has temporarily helped to lower the cost of all other energy sources like coal, gas, hydro and nuclear because having oil to

fuel the vehicles and maintenance crews and equipment to extract and process these other energy sources has lowered the end cost to the user. Without energy there is little growth. If you doubt it, imagine taking away our coal, oil, gas and uranium. Modern society would cease. Energy along with technology as enabled the entire economy. If we were just relying on animal power and perhaps wood, we would have much smaller economies with zero growth. This would explain why most religions centuries ago looked very negatively on the whole concept of charging interest on loans because economies barely grew then. The economy has to grow to pay them back.

Positive interest rates implies growth. The higher the rate, the higher the required growth. Presently the entire world economy tightly coupled as it is to finance is based on creating debit (or credit) and charging interest and having growth.

Back in 1972 the famous Club of Rome report pointed out that we can't grow forever and we will eventually hit limits and even if we alleviate one limit, we will eventually run into other limits. Examples of limits are energy, the amount of CO-2 the atmosphere will accept, the level of pollution, the population, farmland, fresh water etc. We are currently right at the top of Peak Oil. Production has been on a plateau now since around 2004. Despite the price increases, production has not gone up. If in doubt, go and research it yourself. A good starting point is http://www.energybulletin.net -So with Peak Oil signalling the end of growth and the necessity of moving to a sustainable economy -was there ever not a reason?, -the growth rates that the debt relies on is gone. What worse is that the abstract money represented in the financial world through financial derivatives is 10 to 50 times larger than the global economy. If you think about it, the last few years represented the time in human history when we had the most quantity of cheap energy around and it created a frenzy of activity and growth and misplaced optimism that it would never end and it was exactly during this time that capitalism decided to try and reap tomorrows profits today and that was by creating financial derivatives which to a certain extent are promises of future growth since that is what is backing the belief that these debits or obligations of one kind of another could ever be paid.

The realization is that growth era is over is also the realization that these derivatives are worthless. Indeed the rules of the game no longer apply. Naturally everyone has invested their whole thinking about money, debit, the economy and more practically their pensions in this scheme. They know their jobs depend on it too. Obviously huge effort will be expended to save it. A criminal - conspiratorial view point would say the smart people at the top know this and having been swapping paper money for real assets like property, land, mines, energy and other valuable resources and that the bailouts here and everywhere else is their final push to clear their debts before anyone else.

In summary, all these perspectives at looking at the present global financial crisis in which Ireland is very much caught up in, are all correct and valid. I wouldn't disagree with any of them, although one might argue over some finer details. Given that it is true, then the short answer is that the bailout will fail and the global economy will be jolted to breaking point because it structure is incapable of coping with the new reality which is the limits to growth have arrived. Yet, this may not happen all at once. These government reactions may serve to stabilize the situation for a few months during which time enough structural change occurs to allow the system to adopt to some degree, but really this can only happen as long as we don't have business as usual, yet that is the very thing that we are being promised that they want to return us to.

Some people will still dismiss that there are limits and even if there are any, we are not at them. That still leaves the massive debt burdens in place which the tax payer is being asked to pay off. Are you as a worker then willing to accept your new role to be called upon as beast of burden for the bankers and their high-flyer lives?

Can you do anything about it even if you wanted to? If we do nothing to respond, the same will continue and more in the long run will be heaped upon us. So where does it end and how do you get people to accept it? If our real wages don't increase and it is not clear they can, then can we go back to borrowing? Where will the money come from again and who will pay it off again? Only by accepting less and paying the bankers debt, will it be proclaimed that we are getting our feet back on the economy as a country. It is obvious the only means for the top 1% to maintain their power, wealth and status is to increase the amount of force used to keep it that way and that road leads backwards to the past or forwards to the future modern computer full-surveillance police state. The only variable would appear to be how long its going to take.

There was a recent statistic a year or two ago that said that there were 40,000 millionaires in Ireland which sounds like a lot but it is still only 1% of 4 million people. We are not that much different than anywhere else despite the constant implication that we are somehow different. So long as the capitalist media just focuses on these people we will never know how bad it gets for the other 99%.