Government Telling Lies To Protect Apple

national |

economics and finance |

press release

national |

economics and finance |

press release  Monday September 12, 2016 22:00

Monday September 12, 2016 22:00 by pbp - People Before Profit

by pbp - People Before Profit

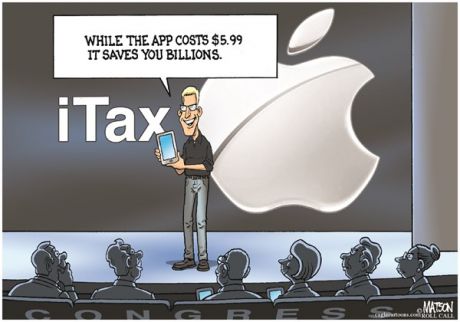

The political establishment have been left reeling by the size of the award made against Apple. They have launched an all-out propaganda war to try to recover ground.

Here are some of the lies and half truths:

‘The EU is attacking Ireland’s sovereignity’ . The same politicians who meekly accepted orders from the European Central Bank to pay out €64 billion in bank bail-outs have suddenly discovered nationalism.

When it comes to water charges or the privatisation of Aer Lingus they tell us to obey the Brussels bureaucracy. But it is a different story when there is a threat to the ‘tax planning’ industry that is staffed full of accountants and lawyers. Then all of a sudden it is time for the green jersey.

The global elite are under pressure and this is leading to splits and divisions. When this happens they spill the beans on how their system really works.

It is a bit like the row in the Dunnes’ family after Ben Dunne jumped out the window, high on cocaine. As the conflict grew, it eventually emerged that he had paid €2 million to Charles Haughey, the former FF Taoiseach.

Today the EU – for its own reasons – has revealed the shady operations of the Irish state. The political elite would never have told us about it.

‘We are not the tax collectors for the world.’ Nobody asked Ireland to play this role. However, Irish tax law is deliberately designed to facilitate tax dodging by corporations on a gigantic scale. The Irish state should just collect the €13 billion (plus interest) for its own people.

‘The arrangement with Apple was perfectly legal’. It probably was – and that is the problem. Irish tax law is written by a right wing establishment to deliberately encourage tax dodging. The US tax rate on profits is 35% and this applies on a global basis.

The Irish elite, however, recognised that US corporations could park their money outside America for decades. They wrote up the tax laws to allow companies to be resident in Ireland but not subject to Irish taxes as long as their Board of Directors met elsewhere.

So US companies have only to claim that their meetings were held in Bermuda to escape US taxes. It was the greatest scam ever –while it lasted!

We have nothing to hide. Well then publish the other 1,000 tax rulings that the Revenue Commissioners gave to corporations as advance notices on their likely tax bill! The EU Commission examined about seven rulings and may eventually publish the details. But if the Irish state has nothing to hide it could make those rulings public now – or at least supply a list of corporations who got them.

If we take the money, foreign investment will flee and there will be no jobs. Just 7 percent of the workforce is employed by foreign multi-nationals. You would think the whole country was working for US companies when they trot out figures – without giving the percentage of the labour force.

These companies are highly unlikely to leave Ireland because it is becoming harder to locate inside the EU – which is what they want – and dodge taxes. Where else will they go?

Moreover, cannot the €13 billion – or more likely €19 Billion – be used to create jobs and change industrial strategy?

For every 1 billion that is invested, 100,000 people could be paid at the minimum wage. Increase the wages and fewer workers might be employed for each billion – but it would be a good start in a real jobs programme.

Comments (3 of 3)

Jump To Comment: 1 2 3yes. we are watching.

I think the problem is;Ireland never made any widgets for apple or had the design concept,so it doesn't warrant that 13 billion(plus interest).

The Eurocrats are using this as a test case in Ireland and do not care about the fallout for the Irish economy.They see Ireland doing well with multinational jobs,and where did you pull that 7% figure from,your ass??The Eurocrats are hoping to hold a test case on our turf because the end game is they see us doing well with multinationals and want a slice of the action, ie they want to commute irish jobs to mainland Europe.....Is it really wise to take this 13 billion(plus interest) when if we DO TAKE IT - it will be divvied up amongst EU states,America and China.....We will be left with crumbs and a BAD reputation that will damage the jobs economy as other businesses will take note...

This is just plain wrong:

..it will be divvied up amongst EU states,America and China...

We would get the money. The EU has not suggested it is due to them. As for America and China, even more bizarre statement

Indymedia Ireland is a media collective. We are independent volunteer citizen journalists producing and distributing the authentic voices of the people. Indymedia Ireland is an open news project where anyone can post their own news, comment, videos or photos about Ireland or related matters.